Senior Retirement Communities

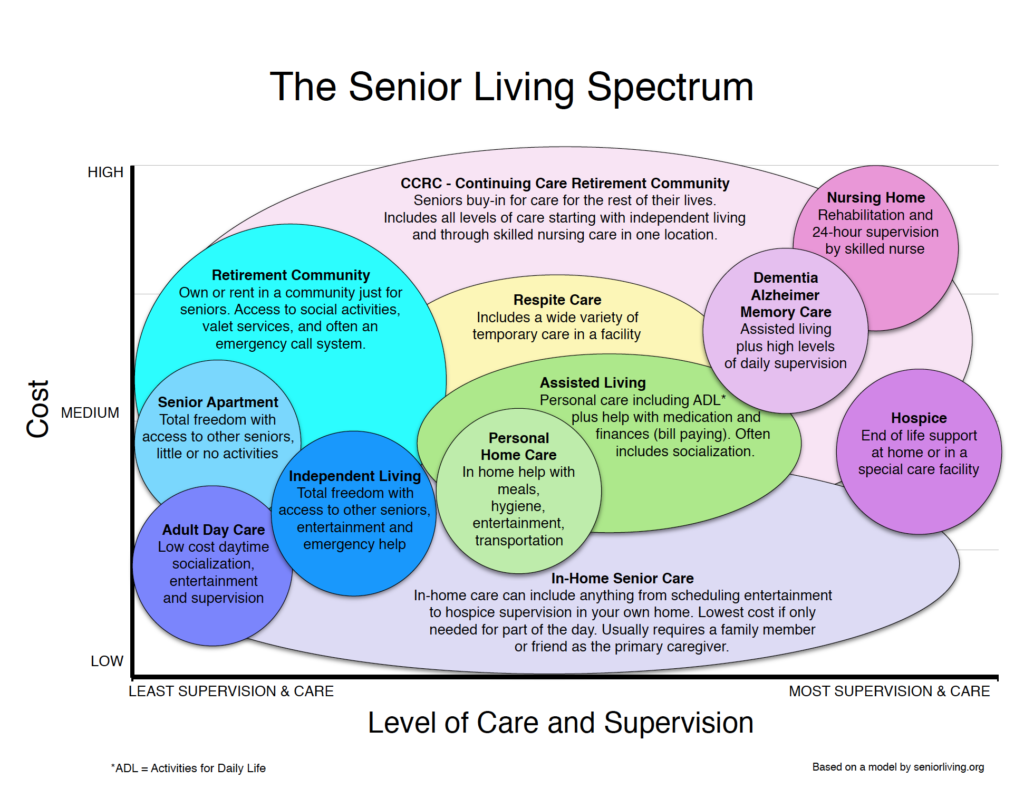

As seen in the above infographic, “retirement community” is a broad term covering many housing options for seniors. There are active senior communities, age-restricted (e.g., 50-plus, 55-plus, 62-plus) communities, and independent living communities. Though these communities vary somewhat, they are all tied together by their residents: older adults who want to remain as independent as possible through their retirement years. Retirement communities have different types of amenities, such as fitness clubs and medical facilities. Within each of these broader communities, there are subcategories, catering to specific lifestyles, such as resort and golf communities, RV living, and single older adults. A retirement community isn’t just a neighborhood for seniors in places like Florida or Arizona. Today, specialized communities suited to every stage of senior living and lifestyle have sprouted up everywhere from Alaska to Alabama. In this guide, we’ll look at what you can expect from retirement communities in general. We’ll also look at some of the more specialized communities out there. Retirement communities are designed with seniors in mind. That means conveniences, ease of use, and amenities. Conveniences could be a neighboring hospital, a shopping center, or an on-site restaurant. Homes are usually fitted with easy-to-reach cabinet doors, higher toilets, open and single-level floor plans, and other ways to make senior living easier. Amenities include fitness centers, craft classes, billiards rooms, walking trails, indoor/outdoor pools, tennis courts, golf courses, religious services, local transportation, security, and many other ways to stay active.

As seen in the above infographic, “retirement community” is a broad term covering many housing options for seniors. There are active senior communities, age-restricted (e.g., 50-plus, 55-plus, 62-plus) communities, and independent living communities. Though these communities vary somewhat, they are all tied together by their residents: older adults who want to remain as independent as possible through their retirement years. Retirement communities have different types of amenities, such as fitness clubs and medical facilities. Within each of these broader communities, there are subcategories, catering to specific lifestyles, such as resort and golf communities, RV living, and single older adults. A retirement community isn’t just a neighborhood for seniors in places like Florida or Arizona. Today, specialized communities suited to every stage of senior living and lifestyle have sprouted up everywhere from Alaska to Alabama. In this guide, we’ll look at what you can expect from retirement communities in general. We’ll also look at some of the more specialized communities out there. Retirement communities are designed with seniors in mind. That means conveniences, ease of use, and amenities. Conveniences could be a neighboring hospital, a shopping center, or an on-site restaurant. Homes are usually fitted with easy-to-reach cabinet doors, higher toilets, open and single-level floor plans, and other ways to make senior living easier. Amenities include fitness centers, craft classes, billiards rooms, walking trails, indoor/outdoor pools, tennis courts, golf courses, religious services, local transportation, security, and many other ways to stay active.

Types of Retirement Communities

A senior retirement community offers three main features — security, senior-focused amenities, and a sense of community. Security ranges from gated facilities to emergency alarm response features within the senior homes. Amenities for seniors are based on the age, abilities, and interests of adults aged 55 and older. A sense of community allows older adults to maintain social connections with other residents who are in the same stage of life. There are four main types of senior retirement communities that fit this description. These include:

- Assisted living retirement communities

- Independent living retirement communities

- Age-restricted retirement communities

- Lifestyle retirement communities

Read on to learn more about each of these four categories of retirement communities for seniors.

Assisted Living Retirement Communities

Assisted living retirement communities provide a moderate level of care. This type of living arrangement allows seniors to live in their own homes (i.e., apartments, condos, or single family dwellings). However, they also receive assistance for basic and vital needs, such as help with getting dressed, meal preparation, taking medication, and transportation.

According to the National Center for Assisted Living, these communities may also specialize in dementia care or provide tailored care for certain diseases. These diseases include diabetes, depression, and cardiovascular disease. Keep in mind: An assisted living facility does not provide most health care services directly. However, these facilities will work in tandem with health care providers, such as dentists, hospice nurses, podiatrists, counselors, and physical therapists. This allows residents to benefit from specialized care while living in assisted living, rather than having to move to a nursing home or inpatient setting.

Independent Living Retirement Communities

Simply put, independent living communities are designed for active, healthy seniors who are able to live on their own. You can live in a home, townhouse, condo, and even a mobile home or motorhome. You can own or rent or live as part of a cooperative. Think of it like living in your old neighborhood except these communities have age restrictions — usually over 55 — and most offer amenities like clubhouses, gyms, yard maintenance, housekeeping, and security. Independent living communities also typically offer transportation, laundry service, group meals, and social and cultural activities.

Age-Restricted Retirement Communities

Age-restricted communities are often marketed to certain ages, such as 55+ communities. Some communities — marketed as “age-qualified”— require at least one person who is 55 to live in at least 80 percent of the occupied units. These properties are regulated by the U.S. Department of Housing and Urban Development (HUD) and The Fair Housing Act. Also, people under 19 years of age cannot be permanent residents. The communities that are marketed to a certain age group without formal age restrictions are called “age-targeted.” These communities focus on the senior demographic with amenities and conveniences, but anyone can live there regardless of age.

Lifestyle Retirement Communities

With 73 million baby boomers beginning to retire, the demand for retirement communities is greater than ever. There are senior living options for a wide variety of lifestyles. Here’s a sampling of some specialized retirement communities:

- University and college-based retirement communities

- Faith-based retirement communities

- Golf retirement communities

- Boating retirement communities

- Artist retirement communities

- LGBTQ+ retirement communities

- Manufactured/modular home communities

- Luxury apartments

- Singles sharing homes

Retirement Community Options

When choosing the best type of retirement community for your needs, consider the options available to you based on location, financial resources, level of care, and expectations. For example, if you have unlimited funds and are an active senior, you can choose luxury retirement communities, active senior communities, and continuing care retirement communities (CCRCs) anywhere in the nation. For seniors who are on a fixed income, note that most retirement communities have two major fees. These include a one-time lump sum to pay for the housing and a place within the facility. This ranges from $100,000 to $500,000 at the more modest senior retirement communities. On top of this, residents will be responsible for paying a monthly fee that covers services, such as food, housekeeping, and activities. If you are considered low income, you will need to look for affordable retirement housing, such as low-income senior housing. This is provided via HUD through your local Department of Family and Human Services.

Retirement House Communities

Retirement house communities are perfect for older adults who want to live in single-family housing. This type of senior housing can be found in specialty communities, such as university-based retirement communities, senior golfing communities, senior living co-ops, and CCRCs. Note that when you purchase a house for senior living within a retirement community, you will be paying the mortgage on the home. In addition, most of these communities feature homeowners associations (HOAs), which will require you to pay yearly HOA dues. In essence, you are living in a stand-alone home in a neighborhood where you have total freedom and autonomy. Yet your neighbors are all older adults who may have the same interests and lifestyles, allowing for a cohesive community. Your HOA will typically provide services geared toward older adults, such as inclusive lawn care and wheelchair-approved walkways and paths. This type of senior housing is best suited for individuals with a minimal level of care. However, you do have the flexibility to hire a private in-house nurse who can care for you in your home if needed.

Retirement Apartment Communities

The most common type of senior housing in retirement communities is apartment units. An apartment unit for luxury retirement communities is typically referred to as a condo. Meanwhile, low-income older adults can live in apartments commonly known as Section 8. Ultimately, with a senior retirement apartment, you would be living in a building where all of the residents are seniors over the age of 55. Keep in mind that with some HUD apartments, there is a stipulation where at least 80 percent of the units must have a resident over 55, but a few residents may be younger than that. Living in an apartment for seniors allows for a tighter knit community, since the units are connected, allowing residents to interact more regularly. Also, apartment managers may be hired to provide additional services especially for senior adults, such as meal preparation or social activities. As for paying for a retirement apartment, older adults typically pay rent on a monthly basis. Depending on the type of housing unit, i.e., a low-income apartment, the rent may be based on a government guideline or provided for with stipends.

Paying for Retirement Community Living

To cover the cost of a mortgage along with HOA dues or monthly service fees, older adults living in a retirement house will often choose one of two routes. They will take out a reverse mortgage on their primary home or property, which allows the homeowner to use their home equity as cash that is then used to pay for a senior home. Otherwise, the senior can sell their primary home outright and use the proceeds to cover the costs of a senior house. For a senior apartment, these are secured through monthly rent payments. This works the same as a senior apartment for adults in terms of costs; there is no lump sum to be paid up front. However, if the senior is living in an assisted living facility or specialized care, they will have to pay more for additional health care services not included in the facility’s basic amenities. According to Genworth’s Cost of Care Survey, the national median cost for assisted living was around $4,500 per month in 2021, which adds up to $54,000 annually. Paying for a senior apartment on a monthly basis typically involves taking funds from several sources. This includes Social Security benefits, retirement accounts, and personal savings and investments. You may also need to utilize financial resources from your children or other family members to help pay for senior housing. Charity organizations can also help low-income seniors pay for affordable senior housing.

Beyond the Marketing Brochure

Finding the right mix of conveniences and amenities at an affordable price is the surface stuff. Factors below the surface, the ones that aren’t mentioned in the marketing, are just as important. These things can go a long way to making your retirement years enjoyable. Below are some considerations and questions to ask as you tour a retirement community.

- Talk to residents. Do they live there part-time or all year round? Are they happy with where they live? What do they dislike about the community? Were there any surprises? Is the property management company responsive to issues or requests?

- Ask the residents about the HOA. Do they attend meetings? If so, how are the meetings held? Do residents get ample time to speak?

- Is the developer financially solid? Are there resources in place to resolve any construction issues? What are the plans for further development? Have they built other communities? How are those communities functioning?

- Is there a reserve fund (aka “sinking fund”) for maintenance? This is set aside money for things like roof replacement, air conditioning replacement, and so on. This fund is typically a line item on the HOA’s budget.

- If there is surrounding, undeveloped property, who owns it, and how will it be used in the future? Is it a commercial property? Mixed use? You probably don’t want a shopping center or airport built in the adjacent land.

- Get a copy of the HOA’s bylaws. Are there any rules you couldn’t live with? Some communities won’t allow any changes (like painting or modifications) to the exterior of the property without HOA approval. Others won’t allow any flags — even the American flag — to be displayed outside.

Are There Communities or Retirement Homes Near Me?

To find a retirement community near you, start with the type of community you want to live in. The National Center for Assisted Living provides information on finding assisted living retirement communities. Search for your state to find out the state chapter of the NCAL. Go to your state’s NCAL webpage to search for care providers in your state. Finding an independent living retirement community is a bit more difficult. In most communities, you will need to search for independent living communities online or via telephone. Some communities, such as San Diego County, California, have an Independent Living Association that is part of the Department of Health and Human Services. You can check with your DHHS to see if they have such an association or listing of independent senior living communities. For age-restricted retirement communities, you will need to contact independent living facilities to see what their age requirements are. Most of the time, the age minimum will be 55, while some housing providers will set the age limit at 62 or older. As for lifestyle retirement communities, you will want to reach out to various organizations, associations, or clubs within a certain lifestyle. For example, university-based retirement organizations are sponsored by universities and colleges. Golf course retirement communities are affiliated with golf clubhouses. Choose a lifestyle that you prefer and start your search within that niche for senior housing of this type. Boost-retirement-income the-latest-on-social-security retirees-and-tax-refunds retire-at-age-65-retired-sooner-than-expected

Custom Senior Living Facilities from Golden Placements:

In conclusion, even in customized personal living facilities with multiple access to activities your senior loved one can get bored. We try to help by offering communication ideas gathered over years of experience being Golden Placements Senior Placements Specialists. Portland Senior Living and their various options are offered as a free service from our Golden Girls specialists to you. We can help you find a perfect match! Here are more resources to help you learn more about our services:- Golden Placements RESOURCES to find CARE Services – Quality locations for you Senior Loved One with the Golden Girls

- Senior Living Near Me – Adult Home Placement

- Explore Residential Care Homes for Elderly “near me”

Diane Delaney, Placement Specialist Extraordinaire

Delaney is the founder of Golden Placement Services. She began this business with a healthy dose of compassion for helping families make educated decisions regarding senior placement. Focused to relieve stress in uncertain senior housing crucial moments. Diane brings about loving change of lifestyle with grace. Additionally, Diane is an accomplished executive manager, Director of Operations in senior housing. Emphatically, she enjoys sharing her experience by writing about the full spectrum of the transition process for seniors and family members. Read more from Senior Placement Specialist Diane: Ultimate Senior Living Resource Guide >>

LaVona Tomberlin, Senior Placement Specialist